[GUEST POST]

Is It Time to File Quiet Title Actions on Foreclosed Homes?

THIS IS NOT Intended to Be Construed or Relied upon as COMPETENT LEGAL ADVICE—it is an academic paper discussing various perceptions of evolving potential facts and law, which may differ state by state and within jurisdictions within states. Readers are urged to obtain competent legal representation to review their facts.

In the past, foreclosed homeowners and their attorneys have discussed the utility of filing quiet title actions where homes have been seized and deficiency judgments entered by various foreclosure claimants that purport to unknowingly rely on faulty documentation. There are dangers. A buyer that has acquired a foreclosed home—or the foreclosing entity itself—may bring an action against a dispossessed person seeking redress. A pro se plaintiff or an attorney that represents the wronged homeowner may be subject to sanctions for raising a spurious or improperly supported claim. Today facts appear to put a defense attorney at risk of malpractice if he does not preserve his clients’ interest—even post foreclosure—unless he apprises the client of the opportunity to regain title to the family home. Courts have notice of these defects by reason of withdrawals of support documents—beyond GMAC.

Recent disclosures and admissions by document creation groups, together with widespread newspaper reported facts open avenues to additional discovery and formulation of academic legal opinion. These will open the door for claims to set aside erroneous judgments and/or pursue damages against those servicers, Indenture Trustees and document preparers that either knowingly, negligently, or acted with willful disregard to perpetrate fraud on the courts and the hapless home-owners. Mortgage-backed securities investors may also find an interest in these activities. Failed documentation may disguise outright fraud. Attestations and sworn affidavits serve a fundamental purpose—prevention of fraud. These are not mere technicalities as propounded by some industry apologists. Certainly, homeowners with continuing duties of enforced silence may have opportunity to re-open their settlements in light of these possible fraudulent impositions and inducements.

There are at least two sets of circumstances raised to date whereby potentially void or voidable documents have been used to push homeowners into the streets and into bankruptcy;

- Complaints in foreclosure supported by assignments of mortgage from purported representatives of MERS to various entities

- Motions for Summary Judgment supported by Affidavits of Claimants—most notably GMAC’s Jeffrey Stephan

On September 23, 2010 the Washington Post added to the furor surrounding the (majority) federal government owned [ALLY] GMAC’s revelations from earlier this week. GMAC used affidavits executed by an employee, Jeffrey Stephan, who admitted in deposition testimony in December 2009 and June 2010, that he did not actually verify the mortgage foreclosure information to which he was testifying in connection with the foreclosures of two families.

In addition, he admitted signing these “affidavits,” and passing them for later notarization in bulk, a violation of proper notary procedure. Mr. Stephan signed off on 10,000 mortgage documents per month according to his June deposition and the Post article. GMAC, in this instance, took the honest and safe course of “temporarily suspending” some foreclosure-related activities in 23 states – as reported by several large newspapers, including the New York Times, Bloomberg and The Washington Post. The “temporary suspension” allows for evaluation of the impacts of this admitted breakdown in the system, rather than blatantly defrauding foreclosure courts in judicial foreclosure states. The New York Times on the 22nd speculated that: [GMAC] “actions suggest concern about potential liability in evicting families and selling houses to which it does not have clear title.” [Emphasis added] The same article notes that; “The lender said it was also reviewing completed foreclosures where the same unnamed procedure might have been used.” [Emphasis Added]. The step referred to in these articles, preparation and filing of an affidavit in support of a Motion for Summary Judgment—along with the Motion itself –occur well into the foreclosure process.

However, there is another critical document created and filed by a claimant with the foreclosure court at the beginning of foreclosure. This document, the Assignment of Mortgage, is supposed to support the claimant’s right or legal “standing” to press the Complaint in Foreclosure. The Complaint is the basis for the foreclosure and creation of a “deficiency judgment” – the amount left owing by the homeowner after the claimant sells the house for less than the amount owed and includes added fees and charges. The claimant uses the deficiency judgment to seize the homeowner assets and future paychecks. In most instances the assignment is the only document before the court that associates the claimant with the borrower. The complaint and supporting assignment frequently surprise and confuse the homeowner by naming an entity or sham “trust” that the homeowner has never heard of before.

The Assignment of Mortgage is significantly more important than the affidavit in support of the Motion for Summary Judgment, if for no other reason sheer numbers. Typically most homeowners have undergone a psychological bruising and beating from the loan servicer by the time the actual Complaint in Foreclosure is filed. Often the family has lost the pay of one, if not both, wage earners and seeks some relief from one of the high cost, predatory loans created 2003-2007. Unfortunately the servicer typically refuses to discuss modification or any relief unless the homeowner has fallen behind in payments. The servicers may rely on terms limiting its authority within the securitization documents in respect of this hard-nose approach.

The hard-nose response gives the servicer cover for actions or abuses that often characterize its subsequent conduct. At that point, the servicer transfers the loan to the default department or outsources to a “default management” operation. This is an aggrandized term for collection agency. The “department” or collection agency often calls the family up to six or more times a day demanding money—rarely the same caller twice. Typically, this will throw the family into confusion and despair. Pleas for relief fall on deaf ears unless the family meets demands to “make up late payments and added fees.” It’s just the beginning of a process that has the effect, if not the purpose, of destroying the family’s morale. The servicer may follow up with notices tacked on the homeowner’s door, a barrage of ominous if not outright threatening letters and other actions aimed at driving the homeowner to abandon the home and neglect a legal defense.

If the homeowner is either naïve enough to believe that the touted voluntary [for servicers] relief programs actually operate, or desperate to keep a roof over the family’s head, the loan modification dance begins. Under the guise of compliance with HAMP, the collection agency demands an array of homeowner financial and employment information. Irrespective of the use that the homeowner desires for that information, it will be of great help to the collection agency to locate assets and paychecks down the road to collect the looming deficiency. But today the information rarely satisfies the servicer in respect of moving towards a modification. The demanded documents are often purportedly “lost” by the servicer, or deemed inadequate—anything to drag out the nightmare and break the family’s spirits. After submitting and resubmitting documents, explanations, and hours on the telephone day after day, week after week, any false hopes that are raised are destroyed by a denial. Homeowners often will be told to try again-with the same results.

After about 3-4 months, perhaps even while the family thinks that a modification is soon to be forthcoming, the ax falls instead. An assignment is “created” and the Complaint is filed. Usually the family gives up without opposition at this point. The servicer may go so far as to place a note on the door offering to further discuss modification leaving a phone number. When the number is called by the confounded homeowner, the servicer representative may explain: “we didn’t really mean that; we just wanted to see if you have left yet!”

In some cases born of desperation, the struggling family may contact an attorney who demands $1000-$5000 just to open the case. The family has 30 days to raise the money to cause someone to simply look at the demands in the Complaint and the Assignment. In the vast majority of cases still remaining, the family gives up now, abandons the property, and no response is ever filed to the Complaint—a default judgment is entered in favor of the claimant. Most often, the family is not even aware that the demands seek more than just the home. That realization may take years to occur—when another collector knocks on the door demanding the long-forgotten deficiency. The process is aimed at breaking the family’s will, at winnowing out the homeowners. The servicer wants the home!

The articles printed prior to Sep 23, 2010 in connection with GMAC’s “unnamed procedure” did not focus upon the issue of potential forgery or related systemic fraud on the courts in connection with preparation of Assignments of Mortgage. By way of background, by reference to numerous anecdotes, it appears that often a claimant in possession of a list of homeowner loans in default provides superficial information to a default services company in respect of the borrower and property. One of the largest default service providers, by its own admission, is two-year old publicly traded Lender Processing Services (“LPS”), a spin-off from FINS. “Approximately 50 percent of all U.S. mortgages by dollar volume are serviced using LPS’ Mortgage Servicing Package (MSP)” The lender, a servicer or Indenture Trustee contracts with LPS for creation and delivery of an Assignment of Mortgage to the requesting entity. (see exhibit at end) This document is often sent directly by LPS through the mail to County Recorders to be file-stamped and recorded in the county property records. These steps lend false authenticity to the piece of paper. By the time the targeted family sees the Complaint and attached Assignment, the assignment has been file-stamped by their local County Recorder, the Clerk of Courts and probably was attached to a subpoena “served” upon them by their County Sherriff. The family is thoroughly intimidated by the Assignment of Mortgage, which has been used to convert the family’s local authorities into apparent agents and enforcers of the distant claimant. The assignment is a powerful weapon in the war of intimidation.

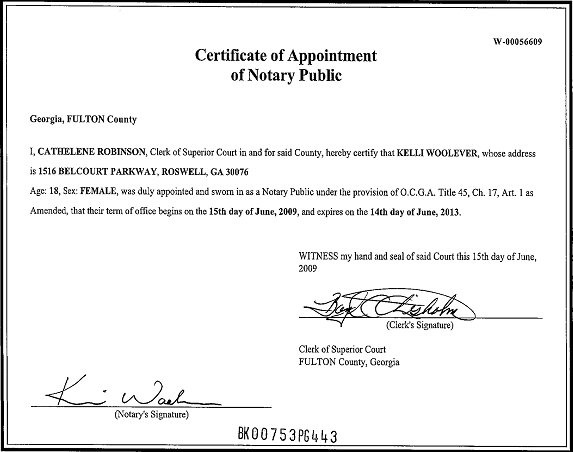

The Washington Post, September 23, 2010, correlated the GMAC admitted breakdown in verification of loan files and notarization process with the assignment creation process operated by LPS. LPS’ document creation division in Alpharetta, Georgia operating under LPS’ DOCX trademark, churned out thousands of assignments. The Post identified one prolific signatory, Linda Green. The article set out in its body several examples of Ms. Green’s signature—which differ dramatically one to another. The Post stated the likely observation that the signatures were made by other LPS employees in addition to Ms Green. She is but one example at one LPS office: there are others with similar handiwork including Tywanna Thomas and Korrel Harp at that office. Mr. Harp has the added dubious distinction of having been jailed for and plead guilty to “Knowingly Possessing False Identification” relating to an arrest in Oklahoma in 2008. At the age of 24, Mr. Harp was signing as Vice-President of Mortgage Electronic Services Inc., aka MERS. MERS has been nominal owner of 65 million home mortgages—and receives mortgage title to 60% of all new mortgages.

As a VP of MERS the 24 year-old Harp, like Ms. Green and Thomas, purportedly possessed the power to transfer mortgages with questionable oversight to LPS’ clients—perhaps others? Based on the signatures of Harp, Green, Thomas— and other varied, yet purportedly notarized signatures, Courts across the country have foreclosed on homes and granted deficiency judgments. One of the in house LPS notaries was only 18 years old at the time she notarized signature for Harp, Thomas and others at DOCX. Michelle Kersch, a senior vice president for Lender Processing Services, made limited explanations by email in the Post article but did not elaborate “due to the pending criminal investigation”.

Like GMACs Stephan, LPS’ stamp and sign department was a high volume operation. Powers of attorney were not consistently attached to the crucial assignments—if at all.

In the case of Linda Green, there was no power of attorney to represent MERS on an original “assignment of mortgage dated October 17, 2008 and filed on October 13, 2009”. This technicality was disclosed in a corrective filing of assignment by Florida foreclosure firm Shapiro and Fishman dated August 11, 2010 in Lee County, Florida in support of a foreclosure by servicer AHMSI. The POA status of other prolific signers such as Harp seems equally uncertain—but as Harp has emphatically stated “I’m sure everything is legal.” There seems to be little observable difference between the conduct of GMAC’s Stephan and the LPS’ high volume signers—but for the possible failure of the LPS signers to have representative capacity to sign at all.

LPS has also made admissions that GMAC seems to echo in terms of problematic “processes”. In the company’s 2009 Annual Report on file with the Securities and Exchange Commission, published in March 2010, under “regulatory matters”–“Recently, during an internal review of the business processes used by our document solutions subsidiary, we identified a business process that caused an error in the notarization of certain documents, some of which were used in foreclosure proceedings in various jurisdictions around the country.”

Subsequently, April 3, 2010, the Wall St. Journal published an article regarding the issues with LPS and notary deficiencies; “US Probes Foreclosure-Data Provider”. Foreclosure activists in Florida did not let the admission pass. These persons identified and brought to light signed and notarized Assignments that actually conveyed mortgages to named entities, “Bogus Assignee” and “Bad Bene”. These clearly established undeniable proof that LPS’ internal controls were compromised and virtually any name could be inserted as a claimant in a foreclosure action.

LPS’ CEO Jeffrey Carbiener authored a Letter to the Editor of the Florida Times-Union responding to an article published May 14, 2010 referring to “bad bene” and “bogus assignee”. In his open letter admissions in the press Carbiener asserted that the bogus names were “placeholders” put in the signed and notarized assignment documents “…until the missing information [claimant name] was provided…” Carbiener noted that the forms, as well as the data inserted, were based on instructions from clients with the “placeholders” used until more data is provided. This amounts to a Nuremberg Defense.

The Carbiener comments attempt to place the onus of error in naming mortgage claimants on his clients—but for the obvious so-called placeholders. However, Carbiener’s comments have great significance beyond LPS role. This explanation is an admission that assignments were prepared in blank based on client information. According to Carbiener, it would appear that the named claimant was subsequently determined by the client and inserted. This process allows substantial opportunity for abuse, suggesting that a servicer determined that a loan was in default, and then someone engaged in a separate process to identify a claimant to whom the proceeds of foreclosure would be awarded.

The difficulties, or opportunities, for a servicer and his client Indenture Trustees to shift the benefits among potential investor beneficiaries are more apparent when one reviews the SEC filings of now bankrupt mortgage note originators such as American Home Mortgage group (“AHM”) and Option One.

Both originated loans that were supposedly stuffed into trusts. On paper the trusts supposedly issued mortgage-backed securities to trusting investors. However, purported trust-sponsors AHM and Option One and the Indenture Trustees were at best haphazard in meeting basic commitments and representations that were plainly stated in the securitization documents they themselves filed. The trust documents clearly state that the lists of loans included in the trusts were filed with the SEC and the appropriate Secretary of State (UCC). The securitization documents provided detailed descriptions of the information to be included in the filed list. This information was sufficient that a homeowner could determine if the trust owned his/her loan and was the proper party to receive his payments. Investors in the trust MBS could look to the list to determine the principal amount of the loans that “backed” the investment, as well as loan to value ratios and other relevant information that would indicate the value of the loans—and provide information adequate to determine if the same loan was placed in multiple trusts. However, for AHM, 7 of the 12 investment trusts filed with SEC lacked the lists. The schedule stated, “manually filed”, but the manual filing was not made in many instances. The actual manual filings made are identified on the SEC dockets for the trusts as “SE” for “scanned exhibit.” Under the “SE” docket entry, the list would be found in specificity. One such example of a trust with a proper loan list was American Home Mortgage Investment Trust 2005-2.

In motion practice in connection with a homeowner’s motion to dismiss a naked claim by one of Korrel Harp’s or Linda Green’s appointed mortgage assignment beneficiary trusts, one could note that the trust lacked a loan list and ownership of the loan could not be independently verified by reference to government records as intended. In so doing, it was possible to refer the court to the properly filed loan lists to note the clear distinction and value of the list. It was possible to prove that the lists were not intentionally missing due to some overriding concern for homeowner privacy—a common speculation. It was also useful to prove that missing loan lists were not customary “industry practice”. The filed list was a government record freely accessible to the public online. That changed between July 21, 2010 and September 02, 2010. Loan lists that had been on file and available for investors and homeowners to view online on the SE site were unceremoniously deleted. The lists are no longer freely accessible. A demand is now necessary under Freedom of Information Act—the proper loan lists can no longer be referenced in motions to dismiss. The effect was equivalent to, if not the same as, intentional destruction of evidence by the SEC. It is of interest that on the same day as the Washington Post detailed the LPS similarity to GMAC in terms of uncertain document authenticity, the WSJ also ran a front-page article detailing questionable actions taken in recent months by SEC. Washington Post, September 22, 2010, SEC Blasted on Goldman.

In summary, SEC failed to require actual filing of loan lists by the trust sponsors and the Indenture Trustees. This failing has lead to LPS and GMAC transfers of claims to unverifiable beneficiaries. This the Times suggests, creates a cloud on the title of the new home buyers of foreclosed properties. Then to complete the injury and remove opportunity for homeowners to defend unsupported claims, SEC destroys evidence that could be useful to homeowners being foreclosed and investors seeking to prove fraud. The mortgage fiasco has roots in SEC failure to regulate and its continuation and concealment of potential fraud is an abuse of discretion by SEC, which is supposed to support disclosure of information—not hide it.

Excerpted from: DOCX eAssignTM brochure (no longer found online)

eAssign utilizes the industry’s most robust property records database and data capture capabilities to significantly reduce timelines and costs for lienholders when creating (emphasis added) and recording lien assignment documents.

This article was contributed by an anonymous supporter of StopForeclosureFraud.com

© 2010 FORECLOSURE FRAUD | by DinSFLA. All rights reserved. www.StopForeclosureFraud.com

Related links:

LPS 101

MERS 101

NO. THERE IS NO LIFE AT MERS

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

An archive I thought might be worth sharing?:

Bulletin

NUMBER: 2009-16

TO: All Freddie Mac Seller/Servicers June 30, 2009

SUBJECTS

Both selling and Servicing requirements are amended with this Single-Family Seller/Servicer

Guide (“Guide”) Bulletin.

With this Bulletin, we are announcing that beginning October 1, 2009, Freddie Mac will no longer

directly provide Note certification and custody services, and has selected The Bank of New York Mellon

Trust Company, N.A. (BNYM) to perform such services for its Mortgages as Freddie Mac’s Designated

Custodian (Designated Custodian). Among other things, this Bulletin describes the transition of

certification responsibilities and custody of Notes to BNYM. The transition period begins

October 1, 2009, and will extend to the effective date of the custodial relationship the Seller/Servicer must

establish with either the Designated Custodian or another third-party Custodian. The effective date of

either such arrangement is referred to in this Bulletin as the “Custodial Agreement Effective Date.”

The following topics related to this change are addressed in this Bulletin:

.. Seller and Servicer responsibilities related to Note delivery, certification and custody during the

transition period

.. The process and requirements with respect to contracting with the Designated Custodian or, at the

Seller/Servicer’s option, another third-party Custodian

.. The announcement of a new Form 1035DC, Designated Custodial Agreement: Single-Family

Mortgages, that must be used to establish a custodian relationship with BNYM

.. Document custody fees and charges

.. Other miscellaneous matters

As a result of this change, we are also announcing the following:

.. Sellers selling Mortgages to Freddie Mac through the Freddie Mac Selling System (Selling System)

Servicing Released Sales Process (SRSP) must establish a custodial relationship with the Designated

Custodian and deliver Notes for such Mortgages to the Designated Custodian for certification

.. Sellers must deliver the Intervening Assignments when delivering Notes for certification to the

Document Custodian, including BNYM, in its capacity as vendor/agent for Freddie Mac or as

Designated Custodian

.. In connection with Transfers of Servicing or transfers of custody, Servicers must deliver the

Intervening Assignments to the Document Custodian, including BNYM, in its capacity as

vendor/agent for Freddie Mac or as Designated Custodian

Page 1

Key Date – October 1, 2009

As noted above, the transition period begins October 1, 2009, and:

.. The Notes and related documents currently held by Freddie Mac at its Document Custodial

Operations (DCO) facility will be moved to a BNYM vault on or before this date

.. Beginning on this date, Sellers that use DCO to certify Notes and Sellers selling Mortgages under the

Selling System SRSP must deliver the Notes and Intervening Assignments for certification to DCO,

in care of BNYM at a new address. In addition, for Mortgages sold through MIDANET® Sellers must

also deliver a separate data file (see “Certification – sale of Mortgages” below for additional

information).

.. BNYM, in its capacity as vendor/agent for Freddie Mac, will perform Note certification and

custodial services for the Notes delivered or transferred to it beginning on this date and through the

Custodial Agreement Effective Date

In addition, on or before October 1, 2009, each Seller/Servicer currently using DCO must submit either

of the following:

.. Form 1035DC and related forms to BNYM to establish a relationship with BNYM, as Designated

Custodian (see “Contracting with the Designated Custodian” below for additional information); or

.. Form 1035, Custodial Agreement: Single-Family Mortgages, executed by the Seller/Servicer and

another Freddie-Mac approved third-party Custodian, to Freddie Mac requesting approval to enter

into a custodial relationship with a third-party Custodian (see “Contracting with another third-party

Custodian” below for additional information)

SELLER AND SERVICER RESPONSIBILITIES DURING THE TRANSITION PERIOD

Through September 30, 2009

For Sellers and Servicers currently using DCO, the Notes for Mortgages being sold to Freddie Mac or for

which the Servicer acquires the Servicing, should continue to be delivered to DCO in accordance with

existing Guide requirements.

Servicers should continue to deliver supplemental documents, return previously released documents to

and request release of documents from DCO in accordance with existing instructions. Because Notes may

be in transit to BNYM between the date of this announcement and early October, Servicers should

provide as much notice as possible when requesting release of Notes to enable processing in a timely

manner.

Between October 1, 2009 and the Custodial Agreement Effective Date

Between October 1, 2009 and the Custodial Agreement Effective Date, BNYM, as Freddie Mac’s

vendor/agent, will certify the Notes for Mortgages delivered to Freddie Mac (in care of BNYM) and

provide other custodial services for Notes in its custody. Seller/Servicers should direct questions related

to Note certification and other custodial matters to BNYM during this period by calling the BNYM

Document Custody Support Line at (800) 211-2677.

Sellers and Servicers are advised that there may be delays in certification, funding and other services if

documents and/or requests are not delivered in accordance with the following instructions.

Between October 1, 2009 and the Custodial Agreement Effective Date, Sellers and Servicers must use the

following address when delivering Notes for certification to DCO, delivering supplemental documents or

returning previously released documents:

Freddie Mac – Document Custodial Operations

c/o The Bank of New York Mellon Trust Company, N.A.

2220 Chemsearch Blvd., Suite 150

Irving, TX 75062

Page 2

Certification – sale of Mortgages

In connection with the delivery of Notes to Freddie Mac, beginning October 1, 2009:

.. Sellers must also deliver the Intervening Assignments to BNYM for such Mortgages, unless the

Mortgage is registered with MERS and the Seller elects to retain the assignments in its files, as

provided in Guide Section 22.14(e).

.. For Mortgages sold through the Selling System, Sellers will continue to assign the Note to DCO

(“Custodian 9999999”) for certification

For Mortgages sold through MIDANET, the Seller must also provide a separate data file containing all of

the data that must be certified for each Mortgage in the delivery. The data file must be in the form of an

Excel spreadsheet and should be sent to the Designated Custodian via secure email or by emailing the file

using a WinZip advanced encryption or 128-bit Advanced Encryption Standard (AES) with password

protection. Please contact the Designated Custodian for further information and/or assistance.

The data file must include the following data elements in the order specified below:

Freddie Mac Form 1034/1034A Term

1. Freddie Mac Loan Number FHLMC Ln #

2. Seller/Servicer Number Seller/Servicer number

3. Seller Loan Number Seller Ln #

4. Date of Note Note Date

5. Property Address Property Street

6. City Property City

7. State St

8. ZIP Zip code

9. Original Loan Amount Loan Amt

10. Original Interest Rate Interest Rate

11. Original P&I P&I Amount

12. Date of First P&I Payment 1st P&I

13. Original Maturity Date Maturity Date

14. Original P&I Payment P&I Amount

15. Borrower Name Borrower Name

16. Co Borrower Name Co-Borrower Name

17. Modification/Conversion Date Mod/Conv date

For ARMs, include the following additional data elements

18. Convertible Convrt

19. First Rate Adjust Date 1st Rate Adj

20. Index Source Index

21. Index Lookback Days Lookback

22. Note Margin Mtg Margin

23. Interest Rate Rounded % Round

24. First Rate Adjustment MAX 1st Adj Max Initial Rate

25. First Rate Adjustment MIN 1st Adj Min Initial Rate

26. Periodic Interest Rate Cap Period Cap

27. Life of Loan Max Rate Life Cap

Page 3

In addition to the above, Sellers must comply with all other Guide requirements in connection with the

delivery of Notes for certification, including:

.. For Mortgages sold through MIDANET, the delivery of Form 1034, Fixed-Rate Custodial

Certification Schedule, or Form 1034A, ARM Custodial Certification Schedule, as applicable

.. For Mortgages sold through the Selling System, the delivery of Form 1034E, Custodial Certification

Schedule, or Note Delivery Cover Sheet

Release of documents/Transfer of Servicing or transfer of custody

During the transition period, for Notes held by DCO and transferred to BNYM, Servicers must continue

to submit requests for release of documents to DCO directly, in accordance with existing requirements. In

addition, for Notes transferred to BNYM as a result of a Transfer of Servicing or transfer of custody,

Servicers must deliver the Intervening Assignments in accordance with the requirements for Transfers of

Servicing when utilizing a third-party Custodian, pursuant to Guide Sections 18.6, 18.7 and 56.9.

Contracting with the Designated Custodian

Beginning on July 17, 2009, Freddie Mac will email to Servicers currently using DCO to hold the Notes

for Mortgages they service for Freddie Mac the materials necessary to enter into an agreement with

BNYM as Designated Custodian (the Designated Custodian Registration Forms). The email will be

addressed to the Primary Freddie Mac Business Contact as indicated on the Form 16SF, Annual

Eligibility Recertification Report. The Designated Custodian Registration Forms consist of the following

documents:

.. Form 1035DC

.. Additional documents required by BNYM, including

.. Customer Verification Form (“Know Your Customer” form)

.. W-9, Request for Taxpayer Identification Number and Certification

.. Electronic Funds Transfer Authorization

.. Web Access/Release Request Authorization

.. Designated Custodian Fee Schedule

If you are an impacted Servicer and do not receive this email package by July 24, 2009, please contact

Counterparty Credit Risk Management (CCRM) by email to institutional_eligibility@freddiemac.com

or by calling the CCRM customer service line at (571) 382-3434, Opt. 2.

In addition, Sellers electing to sell Mortgages to Freddie Mac through the Selling System SRSP must

complete the Designated Custodian Registration Forms to establish a relationship with the Designated

Custodian. Such Sellers must contact CCRM directly to arrange to receive the registration forms.

As indicated, documents in the Designated Custodian Registration Forms must be completed and signed

as appropriate, and received by BNYM at the following address by October 1, 2009:

The Bank of New York Mellon Trust Company, N.A.

ATTN: New Agreement Execution

2220 Chemsearch Blvd., Suite 150

Irving, TX 75062

Any questions regarding the Designated Custodian Registration Forms should be directed to BNYM via

email at FreddiemacCustodian@bnymellon.com, or by calling the BNYM Document Custody Support

Line at (800) 211-2677.

Page 4

When review of the Designated Custodian Registration Forms is completed, Seller/Servicers will be

notified of their Custodial Agreement Effective Date.

Contracting with another third-party Custodian

A Seller/Servicer currently using DCO that elects to use a third-party Custodian other than BNYM should

follow the procedures set forth in Guide Chapter 18 with respect to contracting with a Document

Custodian and transfers of custody. These procedures include, but are not limited to, submitting Form

1035, executed by the Seller/Servicer and the Document Custodian, to Freddie Mac.

After reviewing the Form 1035 and any other required documentation and approving the request,

Freddie Mac will execute the Form 1035 and communicate the Custodial Agreement Effective Date to

each Seller/Servicer electing to establish another third-party Custodian relationship.

Any questions regarding the Form 1035 should be directed to Freddie Mac via email to

institutional_eligibility@freddiemac.com, or by calling the CCRM customer service line at

(571) 382-3434, Opt. 2.

As noted above, the option to deliver Notes to another Document Custodian is not available for

Mortgages being sold to Freddie Mac under the Selling System SRSP. These Notes must be sent to the

Designated Custodian for certification and custody.

Document custody fees and service charges

Prior to the Custodial Agreement Effective Date, Freddie Mac will continue to bill the Seller/Servicer for

document custody fees and related charges pursuant to Guide Section 18.8.

Using the Designated Custodian

Beginning with the Custodial Agreement Effective Date, BNYM, as the Designated Custodian, will bill

the Seller/Servicer directly for custodial fees associated with certification and custody services occurring

on or after that date. BNYM has agreed that it will not increase fees beyond the fee schedule set forth in

Guide Section 18.8 or impose additional charges prior to September 1, 2010, provided, however, that any

request for expedited release of files or documents will be billed to the Seller/Servicer’s courier account.

Seller/Servicers completing Designated Custodian Registration Forms and submitting them to BNYM by

October 1, 2009 will not incur on-boarding (e.g., transportation or recertification) fees due to the transfer

of Notes to the Designated Custodian.

Using a third-party Custodian

Seller/Servicers choosing to transfer custody to another Document Custodian must negotiate their fee

structure directly with that Custodian, and should consult with that Custodian as to any on-boarding,

recertification and other costs that might be associated with the transfer of custody. Seller/Servicers will

be charged release fees, will incur expenses for shipping, and must have transit insurance for any Notes

being shipped.

Compensation for custodial services

As a reminder, compensation for the custodial services is the sole responsibility of the Seller/Servicer.

Failure to remit payments to the Document Custodian as required by the Guide is a breach of the

Seller/Servicer’s agreement with Freddie Mac and may be cause for termination or other adverse action.

Timing of data in selling system, receipt of Notes, timing of certification and settlement

As always, to ensure timely funding, the Seller should submit the Notes and related data to the Document

Custodian in sufficient time to permit certification, in accordance with the instructions in Guide Section

16.8 and the Document Custody Procedures Handbook, available in AllRegs. For service standards for

the Designated Custodian, please refer to the Service Levels attached to Form 1035DC as Exhibit A.

Page 5

Sellers delivering Notes to BNYM after October 1, 2009 must provide BNYM no less than two business

days’ notice for deliveries involving more than 500 Notes in order for the Notes to be certified by the

desired funding date. It is the Seller’s responsibility to inform the Designated Custodian in advance of any

deliveries in excess of 500 Notes and to deliver such Notes to the Designated Custodian within the time

frames indicated by the Service Levels attached to Form 1035DC as Exhibit A. Seller/Servicers choosing

to use the services of another Document Custodian must negotiate their service level agreement directly

with that Custodian.

Form 16SF – Identity of Document Custodians that hold Notes on behalf of Freddie Mac

Form 16SF automatically populates with information Freddie Mac has on record. The Seller/Servicer

must verify the accuracy of the information and correct it as necessary. For Seller/Servicers currently

using DCO, until the Custodial Agreement Effective Date, the Form 16SF should indicate that

Freddie Mac holds the Notes.

Inquiries on the Form 16SF should be directed to CCRM by either email to institutional_eligibility@

freddiemac.com, or by calling the CCRM customer service line at (571) 382-3434, Opt. 2.

Special Provisions

Seller/Servicers with special provisions in their Purchase Documents related to custodial matters must

inform their new Document Custodian (either the Designated Custodian or other third-party Document

Custodian, as applicable) as to the content of those provisions. Seller/Servicers should provide the special

provision(s) to the Designated Custodian by email to FreddiemacCustodian@bnymellon.com.

Functions that will remain at Freddie Mac

Freddie Mac will continue to perform oversight of document custody program requirements and overall

management of the certification processes and requirements. As such, all Document Custodians will

continue to submit to Freddie Mac the following completed and executed forms, as applicable:

.. In connection with the sale of Mortgages to Freddie Mac through MIDANET, Forms 1034S,

Custodian Certification Schedule Summary, and 1034SM, Custodian Certification Summary for

Multiple Purchase Contracts, upon verifying the documents and performing the certifications

required in accordance with Guide Section 18.6

.. Form 1034B, Custodian Certification Schedule – Balloon Loan Modification, upon certifying the

information contained in a Balloon Loan Modification, in accordance with the requirements of Guide

Section 83.103

.. Form 1034T, Subsequent Transfer Custodial Certification Schedule, upon performing the

verifications and certifications in connection with a Transfer of Servicing/transfer of custody

DCO will continue to:

.. Process requests for assistance with Mortgage discharges, satisfactions, releases of lien or similar and

other matters related to the chain of title for Mortgages owned by Freddie Mac when we are

identified as the lien holder in the land records. Please use the Request for Assistance form found on

our web page at http://www.freddiemac.com/cim/docex.html.

.. Process MERS Transfer of Beneficial Rights and resolve issues concerning transactions affecting

Freddie Mac on the MERS residential system

Page 6

REVISIONS TO THE GUIDE

We will be updating applicable Guide chapters with a future Bulletin to reflect these changes.

CONCLUSION

If you have any questions about the matters addressed in this Bulletin, please contact your Freddie Mac

representative or call (800) FREDDIE.

Sincerely,

Patricia J. McClung

Vice President

Offerings Management

Page 7

Why wait until foreclosure to file a quiet title action? Why doesn’t anyone with a MERS mortgage just file one? Let’s take the offensive here.

Mr. Fletcher has a valid point here. So valid in fact, I wrote a book based on two years of research! Check out the website, read the book … then you can investigate your own situation with the help of an attorney!

What is the website and what is the name of the book/article?

@yvonne, Dave Krieger’s name is linked to his website.

So why aren’t mortgagors filing quiet title suits, or are they? We got a 2008 Wachovia mortgage loan for our house in Hillsborough County FL, assigned to MERS 2 years ago. Wachovia is now out of business (sold to Wells Fargo, I believe), but our loan is now serviced by Chase. We’re not in foreclosure, but Chase is panting on our necks. I’d rather have Chase and MERS and the unknown trust defend their claims to the house in real court (I know a good bit of civil procedure) than to defend against foreclosure in rocket docket court. Two questions, then: 1) Can we assume there’s no note endorsed to MERS or in blank? 2) Why would we fail in a quiet title suit claiming that full title rested in us since no one had standing to foreclose?

There are a lot of great ideas here in this post item. Further research would demonstrate so.

However, some of the most important aspects of real estate are best handeledby professionals with years of field experience. With real estate as it is today, there are a lot of variables.

The real estate professionals (Real Estate Investors, Mortgage Brokers, Real Estate Agents, etc…) that have 10 to 15 years field experienceand have made their business in real estate (and are still in working), are the individuals you need as experts to help handle your real estate issues.

There are also some worthwhile advice and articles at the link(s) I have added in this post.

Great Post! I’ll be coming back soon.

I’m in foreclosure now. But, if I had known earlier, I would’ve filed a Quiet Title claim since both the original/recorded note and title owners (MERS is Nominee on Deed of Trust) would provide no interest statements (or none at all) to the court on the QT claim. In fact, MERS is named as a defendant in my suite to do just that for the claimed new owner.

I guess MERS may have stepped in with an interest claim, though. So, once they are eliminated as beneficial party, a Quiet Title would seem to be a sure thing.

Hi we are in New York and looking for ways to get with Quiet Title Action as we are in foreclosure can anyone help email to ibzp12@gmail.com