NEW YORK COURT OF APPEALS

2006 NY Int. 167

This opinion is uncorrected and subject to revision before publication in the Official Reports.

2006 NY Slip Op 09500

Decided on December 19, 2006

No. 179

In the Matter of Merscorp, Inc., et al., Respondents,

v

Edward P. Romaine, & c., et al., Appellants, et al., Defendant.

Richard C. Cahn, for appellants.

Charles C. Martorana, for respondents.

Mortgage Bankers Association; American Land Title

Association; Federal National Mortgage Association et al.;

South Brooklyn Legal Services et al.; County Clerks of the

Counties of Albany, & c., amici curiae.

PIGOTT, J.

We are asked to decide on this appeal whether the Suffolk County Clerk 1 is compelled to record and index mortgages, assignments of mortgage and discharges of mortgage, which name Mortgage Electronic Registration Systems, Inc. the lender’s nominee or mortgagee of record.

Petitioners, Merscorp, Inc. and Mortgage Electronic Registration Systems, Inc.(collectively “MERS”), commenced this hybrid proceeding in the nature of mandamus to compel the Clerk to record and index the instruments, and to declare them acceptable for recording and indexing.

Supreme Court denied in part petitioners’ motion for summary judgment and granted in part the cross-motion of respondents, the Suffolk County Clerk and the County of Suffolk (collectively “the County”), holding that although the Clerk must record and index the MERS mortgage when presented, the Clerk may refuse to record a MERS assignment and discharge, because those instruments violate the “factual mandates” of section 321 (3) of the Real Property Law.

The Appellate Division reversed so much of Supreme Court’s ruling as relates to the assignments and discharges, finding “no valid distinction between MERS mortgages and MERS assignments and discharges for purposes of recording and indexing” (24 AD3d 673 [2nd Dept 2005]). This Court granted leave and we now affirm.

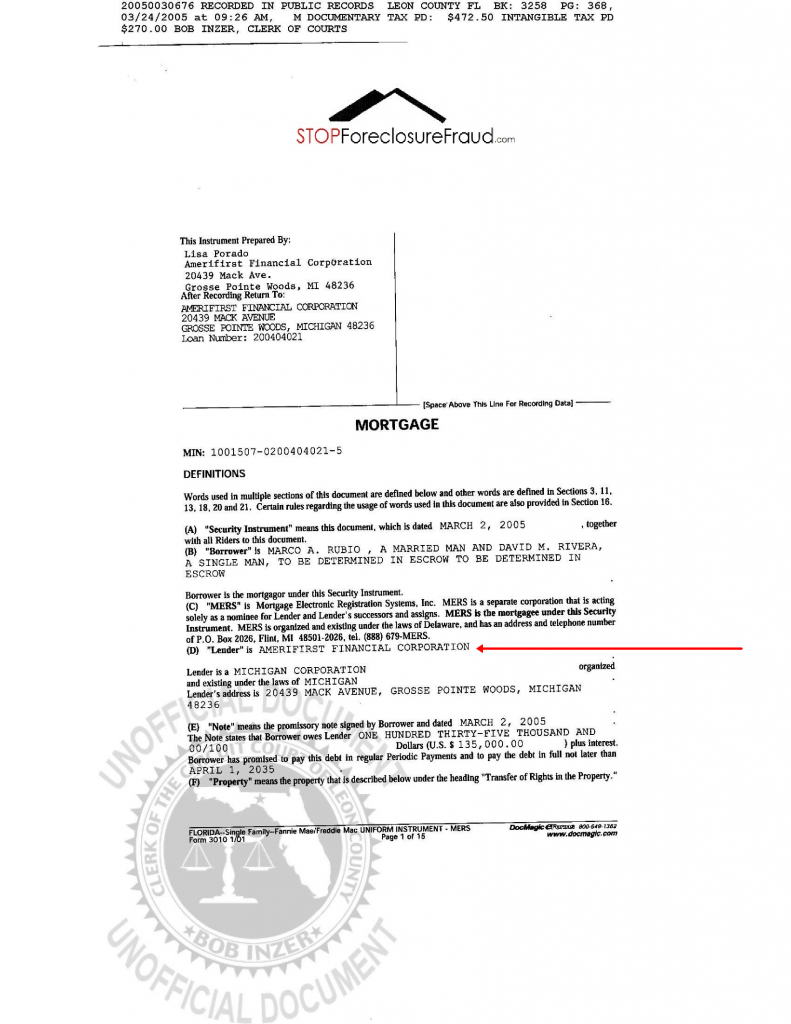

In 1993, the MERS system was created by several large participants in the real estate mortgage industry 2 to track ownership interests in residential mortgages. Mortgage lenders and other entities,3 known as MERS members, subscribe to the MERS system and pay annual fees for the electronic processing and tracking of ownership and transfers of mortgages. Members contractually agree to appoint MERS to act as their common agent on all mortgages they register in the MERS system.

The initial MERS mortgage is recorded in the County Clerk’s office with “Mortgage Electronic Registration Systems, Inc.” named as the lender’s nominee or mortgagee of record on the instrument. During the lifetime of the mortgage, the beneficial ownership interest or servicing rights may be transferred among MERS members (“MERS assignments”), but these assignments are not publicly recorded; instead they are tracked electronically in MERS’s private system 4. In the MERS system, the mortgagor is notified of transfers of servicing rights pursuant to the Truth in Lending Act, but not necessarily of assignments of the beneficial interest in the mortgage.

In April 2001, in response to an informal opinion of the Attorney General, which concluded that recording a MERS instrument violates Real Property Law § 316 and frustrates the legislative intent of the recording provisions (2001 Ops Atty Gen No. 2001-2), the Suffolk County Clerk ceased recording the MERS instruments. This proceeding ensued.

The County contends that the MERS mortgage is improper because that mortgage names MERS, an entity that has no interest in the property or loan, as the “nominee” for the lender. Thus, the County contends MERS is not a proper “mortgagee” and the document created cannot be considered a proper “conveyance” for purposes of the recording statute. We disagree.

Section 291 of the Real Property Law provides, in pertinent part, that:

“a conveyance of real property, within the state, on being duly acknowledged by the person executing the same, or proved as required by [the Real Property Law], and such acknowledgment or proof duly certified when required by [such law], may be recorded in the office of the clerk of the county where such real property is situated, and such county clerk shall, upon the request of any party, on tender of the lawful fees therefor, record the same in his said office”

[emphasis added].

Real Property Law § 316-a, which pertains exclusively to Suffolk County, provides that “[e]very instrument affecting real estate or chattels real, situated in the county of Suffolk, which shall be, or which shall have been recorded in the office of the clerk of said county on and after the first day of January, nineteen hundred fifty-one, shall be recorded and indexed pursuant to the provisions of this act”(emphasis added).

Thus, sections 291 and 316-a of the Real Property Law impose upon the Suffolk County Clerk the ministerial duty of recording and indexing instruments affecting real property (see Real Property Law §§ 290[3], 291, 316-a[1, 2], 321 [1]; County Law § 525[1]). The Clerk lacks the statutory authority to look beyond an instrument that otherwise satisfies the limited requirements of the recording statute (see Putnam v Stewart, 97 NY 411 [1884]). Therefore, the County Clerk must accept the MERS mortgage when presented for recording.

With respect to the MERS assignments and discharges of mortgage, the County argues that by requiring the Clerk to record the instrument, the Clerk is recording a document that ignores the mandates prescribed by Real Property Law § 321.

Section 321(1)(a) provides that where it does not appear from the record that any interest in a mortgage has been assigned, a certificate of satisfaction must be signed by the mortgagee or the mortgagee’s personal representative in order for the recording officer to mark the record of the mortgage as “discharged.” Where it appears from the record that a mortgage has been assigned, the recording officer cannot mark the record of that mortgage with the word “discharged” unless a certificate is signed by “the person who appears from the record to be the last assignee” of the mortgage, or his or her personal representative (Real Property Law § 321[1][b]). As the nominee for the mortgagee of record or for the last assignee, MERS acknowledges the instrument and therefore, the County Clerk is required to file and record the instruments.

Other provisions are not to the contrary. Under section 321 [2], the Clerk is required to record “every other instrument relating to a mortgage,” if that instrument is properly acknowledged or proved in a manner entitling a conveyance to be recorded. Such instruments include “certificates purporting to discharge a mortgage” that are signed by persons other than those specified in Real Property Law § 321(1).

Further, section 321 (3) of the Real Property Law provides:

“Every certificate presented to the recording officer shall be executed and acknowledged or proved in like manner as to entitle a conveyance to be recorded. If the mortgage has been assigned, in whole or in part, the certificate shall set forth the date of each assignment in the chain of title of the person or persons signing the certificate, the names of the assignor and assignee, the interest assigned, and, if the assignment has been recorded, the book and page where it has been recorded or the serial number of such record; or if the assignment is being recorded simultaneously with the certificate of discharge, the certificate of discharge shall so state. If the mortgage has not been assigned of record, the certificate shall so state”

[emphasis added].

Notably, section 321 (3) does not call for the unrecorded MERS assignments to be listed on the MERS discharge. Rather, under the statute, the discharge is required either to list the assignment by the name of the assignor and assignee, the interest assigned, and the book and page number, where recorded, or, if the assignment has not been recorded, to “so state.”

The legislative history of the statute supports this interpretation. In 1951, Real Property Law section 321 (3) was amended to, among other things, insert the term “of record” (L 1951, c 159, § 1). The relevant memoranda submitted to the Legislature in connection with the amendment indicate that the term was inserted to “correct a difficulty” in complying with the statute (see e.g. Memorandum by the Executive Secretary and Director of Research of the Law Revision Committee in support of Bill in Senate). Prior to the amendment, the statute required that a discharge certificate presented to the County Clerk either list all of the assignments in the chain of title or state that the mortgage was unassigned 5. However, problems developed when an assignment, known to the person executing the discharge, was not in the chain of title. In those situations, the person executing the discharge would make the untrue statement that the mortgage was unassigned. Thus, the Legislature amended the statute allowing the discharge certificate to either list the assignments in the chain of title or to state that the assignment has not been made “of record”. The MERS discharge complies with the statute by stating that the “[m]ortgage has not been further assigned of record” and, therefore, the County Clerk is required to accept the MERS assignments and discharges of mortgage for recording.

Accordingly, the order of the Appellate Division should be affirmed with costs.

CIPARICK, J.(concurring):

I am constrained to agree with the result reached by the majority opinion. However, I write independently to highlight the narrow breadth of this holding and to point out that this issue may be ripe for legislative consideration.

I concur with the majority that the Clerk’s role is merely ministerial in nature and that since the documents sought to be recorded appear, for the most part, to comply with the recording statutes, MERS is entitled to an order directing the clerk to accept and record the subject documents. I wish to note, however, that to the extent that the County and various amici argue that MERS has violated the clear prohibition against separating a lien from its debt and that MERS does not have standing to bring foreclosure actions, those issues remain for another day (see e.g. Merritt v Bartholick, 36 NY 44, 45 [1867][“a transfer of the mortgage without the debt is a nullity, and no interest is acquired by it”]).

In addition to these substantive issues, a plethora of policy arguments have surfaced during the pendency of this proceeding. For instance, if MERS succeeds in its goal of monopolizing the mortgage nominee market, it will have effectively usurped the role of the County Clerk that inevitably would result in a county’s recording fee revenue being substantially diverted to a private entity. Additionally, MERS’s success will arguably detract from the amount of public data available concerning mortgage ownership that otherwise offers a wealth of statistics that are used to analyze trends in lending practices. Another concern raised is that, once an assignment of the mortgage is made, it can be difficult, if not impossible, for a homeowner to find out the true identity of the loan holder. Amici who submitted briefs in favor of the County argue that this can effectively insulate a note holder from liability and further that it encourages predatory lending practices.

Unquestionably there is considerable public value in allowing seamless assignments of mortgages in a secondary market. However, whether this benefit will outweigh the negative consequences cannot be ascertained by this Court. Thus, as the recording act, which as relevant here has not been substantially amended in the last 50 years, could not have envisioned such a system nor its ancillary impacts, I feel that such a decision is best left in the hands of the Legislature.

M/O Merscorp. v Romaine

No. 179

KAYE, Chief Judge (dissenting in part):

In 1993, members of the real estate mortgage industry created MERS, an electronic registration system for mortgages. Its purpose is to streamline the mortgage process by eliminating the need to prepare and record paper assignments of mortgage, as had been done for hundreds of years. To accomplish this goal, MERS acts as nominee and as mortgagee of record for its members nationwide and appoints itself nominee, as mortgagee, for its members’ successors and assigns, thereby remaining nominal mortgagee of record no matter how many times loan servicing, or the mortgage itself, may be transferred. MERS hopes to register every residential and commercial home loan nationwide on its electronic system.

But the MERS system, developed as a tool for banks and title companies, does not entirely fit within the purpose of the Recording Act, which was enacted to “protect the rights of innocent purchasers . . . without knowledge of prior encumbrances” and to “establish a public record which would furnish potential purchasers with notice, or at least ‘constructive notice’, of previous conveyances” (Andy Assocs. v Bankers Trust Co., 49 NY2d 13, 20 [1979]; see Witter v Taggert, 78 NY2d 234, 238 [1991]). It is the incongruity between the needs of the modern electronic secondary mortgage market and our venerable real property laws regulating the market that frames the issue before us.

The Suffolk County Clerk, pursuant to the Recording Act, has a duty to record conveyances that are “entitled to be recorded” (Real Property Law § 316-a [5]), and to discharge mortgages when presented with a validly executed and acknowledged certificate of discharge (Real Property Law § 321). Thus, as part of this ministerial duty, the Clerk is called upon to examine an instrument to see that it is, facially, a “conveyance” of real property or to see that the certificate of discharge complies with the statutory mandates. “The performance of his uniform clerical duty requires him to compare the instruments which come to his possession for record . . . and certify as to the identity of their physical contents. Such a certificate does not involve the expression of an opinion, but calls for the statement of a fact capable of absolute demonstration” (Putnam v Stewart, 97 NY 411, 418 [1884]).

When presented with a MERS mortgage to record, the Clerk is able to discern from the face of the instrument that MERS has been appointed, as nominee, “mortgagee of record.” As the instrument appears to reflect a valid conveyance (Real Property Law § 290 [3]), the Clerk is required to record the instrument in MERS’ name “as nominee for lender” (Real Property Law § 291). Given that the identity of the actual lender is ascertainable from the mortgage document itself — indeed, the use of a nominee as the equivalent of an agent for the lender is apparent, and not unusual — I concur with the majority that the Clerk is obligated to record MERS mortgages.1

When presented with a certificate of discharge, however, the Clerk has the duty to examine the mortgage’s prior assignments. The Clerk collects fees precisely for this purpose (Real Property Law § 321 [3] [“the fee or fees which the recording officer is entitled to receive for filing and entering a certificate of discharge of a mortgage and examining assignments of such mortgage shall be payable with respect to each mortgage”]). Section 321 (3) of the Real Property Law further provides:

“Every certificate presented to the recording officer shall be executed and acknowledged or proved in like manner as to entitle a conveyance to be recorded. If the mortgage has been assigned, in whole or in part, the certificate shall set forth the date of each assignment in the chain of title of the person or persons signing the certificate, the names of the assignor or assignee, the interest assigned, and, if the assignment has been recorded, the book and page where it has been recorded or the serial number of such record; or if the mortgage is being recorded simultaneously with the certificate of discharge, the certificate of discharge shall so state. If the mortgage has not been assigned of record, the certificate shall so state”

(emphasis added).

“[W]here the statutory language is clear and unambiguous, the court should construe it so as to give effect to the plain meaning of the words used” (Raritan Dev. Corp. v Silva, 91 NY2d 98, 107 [1997][emphasis and citations omitted]). Plainly, the statute requires all assignments of the mortgage to be listed on the certificate of discharge, whether recorded or not. The statute first sets out this general requirement, then it addresses each possible scenario in turn: if the assignment was recorded, the Clerk must enter the book and page; if the assignment of mortgage is being recorded simultaneously, the certificate shall so state; if the assignment was not recorded, the certificate similarly shall so state. To read the statute as providing that the certificate “either” list the recorded mortgage “or” simply state that the assignment has not been recorded renders the language of the preceding sentences superfluous and the clause regarding the listing of recording details “if recorded” nonsensical.

“[T]he clearest indicator of legislative intent is the statutory text” (Majewski v Broadalbin-Perth Cent. School Dist., 91 NY2d 577, 583 [1998]). The Court need not look to legislative history when the plain meaning of the statute is clear, and

surely should not look to legislative history to override the plain meaning of the statute, as the majority now does.

Here, moreover, the legislative history of § 321 is inapposite. Real Property Law § 321 was amended in 1951 to ameliorate the situation “where assignments are known by the signing party to have existed but are not in his chain of title because the mortgage has been reassigned to the assignor,” such as when “a mortgage has been pledged to secure a loan and on repayment . . . has been reassigned to the mortgagee without the assignment ever having been recorded” (Recommendation of the Law Revision Comm, Bill Jacket, L 1951, ch 159, at 20; see also Mem of Law Revision Comm, Bill Jacket, L 1951, at 11). Thus, the situation the amendment addressed was when a mortgagee’s assigned, unrecorded mortgage was reassigned back to the mortgagee, and the mortgage was then transferred by the mortgagee to a subsequent holder or discharged by the original mortgagee himself. In such a case, “there appears to be no reason for requiring a statement that the mortgage has not been assigned [as] the certificate is executed by the original mortgagee” (Recommendation of the Law Revision Comm, Bill Jacket, L 1951, ch 159, at 20 [emphasis added]), or transferred by the original assignor after it had been assigned back to him (see Report of Comm on Real Property Law, Bill Jacket, L 1951, at 9).

Under the MERS system, by contrast, assignments are made from one lender, to another lender, to another lender, and so on down the line. The 1951 amendment, which assumed that the mortgagee would be discharging the reassigned mortgage, or that a subsequent holder would discharge it unaware that the previous owner had assigned away and been reassigned the mortgage, is thus inapplicable to the issue under review.

The MERS system raises additional concerns that should not go unnoticed.

The benefits of the system to MERS members are not insubstantial. Through use of MERS as nominee, lenders are relieved of the costs of recording each mortgage assignment with the County Clerk, instead paying minimal yearly membership fees to MERS. Transfers of mortgage instruments are faster, allowing for efficient trading in the secondary mortgage market; a mortgage changes hands at least five times on average.

Although creating efficiencies for its members, there is little evidence that the MERS system provides equivalent benefits to home buyers and borrowers — and, in fact, some evidence that it may create substantial disadvantages. While MERS necessarily opted for a system that tracks both the beneficial owner of the loan and the servicer of the loan, its 800 number and Website allow a borrower to access information regarding only his or her loan servicer, not the underlying lender. The lack of disclosure may create substantial difficulty when a homeowner wishes to negotiate the terms of his or her mortgage or enforce a legal right against the mortgagee and is unable to learn the mortgagee’s identity. Public records will no longer contain this information as, if it achieves the success it envisions, the MERS system will render the public record useless by masking beneficial ownership of mortgages and eliminating records of assignments altogether. Not only will this information deficit detract from the amount of public data accessible for research and monitoring of industry trends, but it may also function, perhaps unintentionally, to insulate a note holder from liability, mask lender error and hide predatory lending practices. The County Clerks, of course, are concerned about the depletion of their revenues — allegedly over one million dollars a year in Suffolk County alone.

Admittedly we do not know, at this juncture, the extent to which these concerns will be realized. But it would seem prudent to call to the attention of the Legislature what is at least a disparity between the relevant statute — now 55 years old — and the burgeoning modern-day electronic mortgage industry.

* * * * * * * * * * * * * * * * *

Order affirmed, with costs. Opinion by Judge Pigott. Judges Rosenblatt, Graffeo, Read and Smith concur. Judge Ciparick concurs in result in an opinion. Chief Judge Kaye dissents in part in an opinion.

Decided December 19, 2006

Notes

1 Edward P. Romaine resigned as County Clerk December 31, 2005. Judith A. Pascale is currently the Acting County Clerk.

2 Among the entities creating MERS were the Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation, the Government National Mortgage Association, and the Mortgage Bankers Association of America.

3 Members of the MERS system also include entities such as insurance companies, title companies and banks.

4 If a MERS member transfers servicing interests in a mortgage loan to a non-MERS member, an assignment from the MERS member to the non-MERS member is recorded in the County Clerk’s Office and the loan is deactivated within the MERS system.

5 The purpose of such requirement was to facilitate the work of the recording officer in marking the record of the mortgage.

1 I also agree that the issues concerning the underlying validity of the MERS mortgage instrument — in particular, whether its failure to transfer beneficial interest renders it a nullity under real property law, whether it violates the prohibition against separating the note from the mortgage, and whether MERS has standing to foreclose on a mortgage — are best left for another day. Although MERSCORP initially requested a declaratory judgment that the MERS instruments were “lawful in all respects” (which Supreme Court denied) the instruments’ validity has not yet been addressed.

© 2010-19 FORECLOSURE FRAUD | by DinSFLA. All rights reserved.

Recent Comments